Bagley Risk Management : Safeguarding Your Business Future

Bagley Risk Management : Safeguarding Your Business Future

Blog Article

Exactly How Animals Danger Security (LRP) Insurance Coverage Can Secure Your Animals Financial Investment

Livestock Danger Protection (LRP) insurance policy stands as a trustworthy guard against the unpredictable nature of the market, providing a calculated technique to protecting your possessions. By diving right into the details of LRP insurance policy and its multifaceted advantages, livestock producers can fortify their financial investments with a layer of security that goes beyond market variations.

Understanding Livestock Threat Defense (LRP) Insurance Coverage

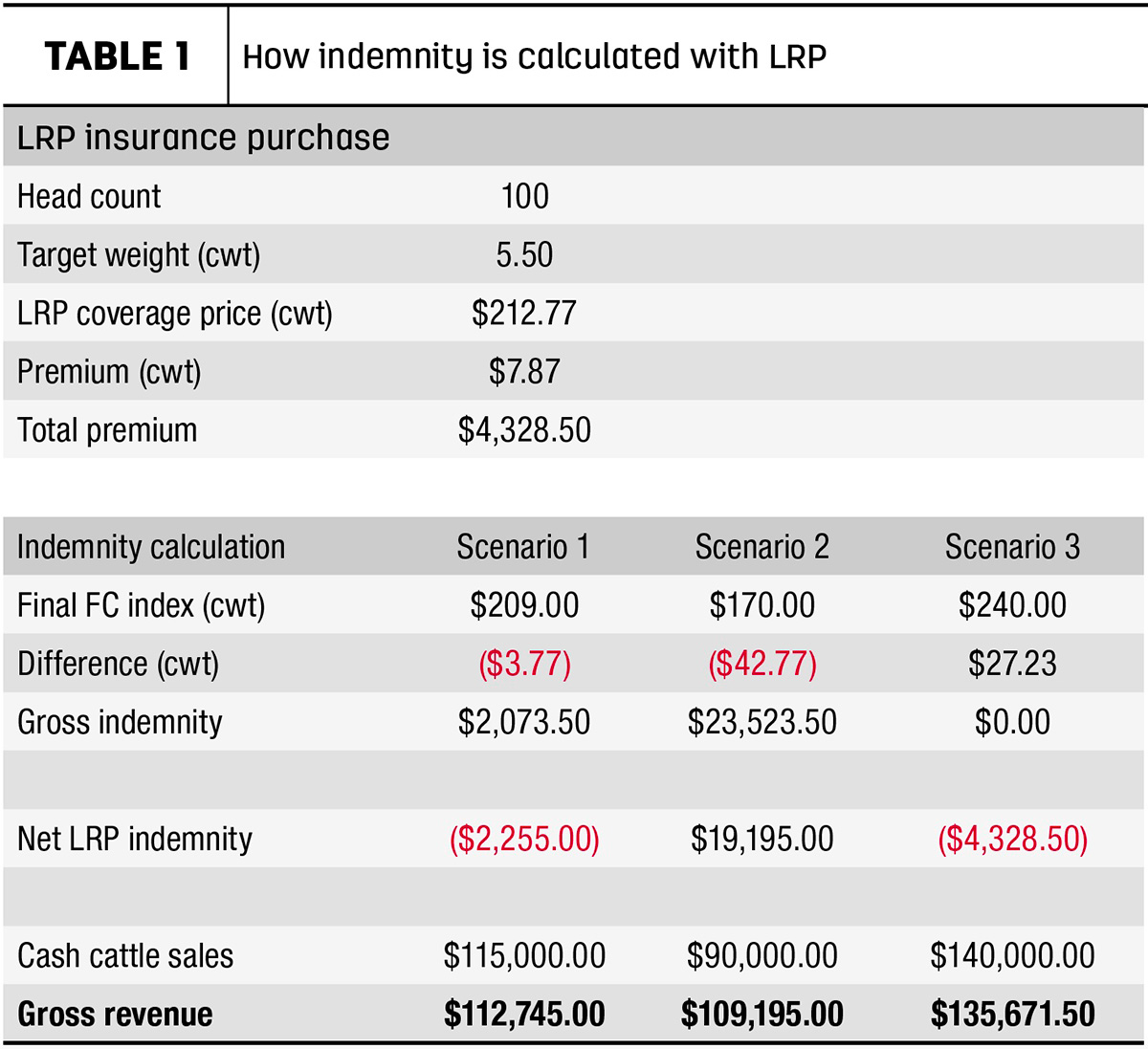

Comprehending Livestock Risk Defense (LRP) Insurance policy is necessary for livestock producers wanting to reduce economic dangers connected with rate changes. LRP is a government subsidized insurance policy product designed to secure producers versus a decrease in market value. By supplying coverage for market rate declines, LRP aids manufacturers secure in a floor cost for their livestock, making certain a minimum level of earnings no matter of market fluctuations.

One secret aspect of LRP is its versatility, allowing producers to customize protection degrees and policy sizes to suit their particular demands. Producers can pick the number of head, weight variety, insurance coverage cost, and coverage duration that straighten with their production objectives and take the chance of tolerance. Understanding these adjustable options is essential for manufacturers to successfully manage their cost threat direct exposure.

Additionally, LRP is readily available for different livestock types, consisting of cattle, swine, and lamb, making it a functional risk management device for animals manufacturers throughout different industries. Bagley Risk Management. By acquainting themselves with the ins and outs of LRP, manufacturers can make enlightened choices to safeguard their financial investments and make certain financial stability despite market uncertainties

Advantages of LRP Insurance Coverage for Livestock Producers

Livestock manufacturers leveraging Animals Danger Protection (LRP) Insurance gain a calculated benefit in protecting their investments from rate volatility and safeguarding a steady monetary ground amidst market uncertainties. By setting a floor on the rate of their animals, manufacturers can alleviate the danger of significant economic losses in the event of market downturns.

Moreover, LRP Insurance coverage provides producers with assurance. Recognizing that their investments are secured versus unexpected market modifications permits producers to focus on various other facets of their business, such as enhancing pet health and welfare or optimizing production procedures. This satisfaction can cause raised productivity and productivity in the future, as manufacturers can operate with even more self-confidence and stability. Overall, the advantages of LRP Insurance policy for livestock producers are considerable, providing a beneficial tool for handling danger and ensuring financial safety and security in an unforeseeable market environment.

Exactly How LRP Insurance Coverage Mitigates Market Dangers

Reducing market risks, Animals Threat Security (LRP) Insurance coverage provides animals producers with a reputable shield versus cost volatility and financial unpredictabilities. By using security versus unforeseen price declines, LRP Insurance coverage helps manufacturers secure their financial investments and keep financial security when faced with market fluctuations. This kind of you can try these out insurance permits livestock manufacturers to lock in a rate for their animals at the start of the policy duration, making sure a minimum cost degree no matter market adjustments.

Actions to Safeguard Your Animals Financial Investment With LRP

In the realm of farming risk administration, applying Animals Risk Security (LRP) Insurance policy involves a tactical procedure to guard financial investments against market changes and unpredictabilities. To safeguard your animals investment efficiently with LRP, the initial action is to assess the particular threats your operation deals with, such as price volatility or unforeseen weather condition events. Next off, it is essential to study and pick a respectable insurance policy service provider that uses LRP plans customized to your animals and organization demands.

Long-Term Financial Security With LRP Insurance

Making sure withstanding economic security through the utilization of Livestock Risk Defense (LRP) Insurance policy is a sensible long-lasting strategy for agricultural producers. By including LRP Insurance policy into their threat monitoring strategies, farmers can secure their animals financial investments versus unanticipated market variations and damaging occasions that might jeopardize their economic health gradually.

One secret benefit of LRP Insurance for lasting monetary safety and security is click to read more the peace of mind it provides. With a trustworthy insurance coverage in position, farmers More hints can minimize the monetary risks linked with unstable market conditions and unanticipated losses because of elements such as condition break outs or natural calamities - Bagley Risk Management. This security permits producers to focus on the everyday operations of their animals service without constant bother with possible monetary setbacks

Moreover, LRP Insurance gives a structured approach to handling risk over the lengthy term. By setting specific protection degrees and choosing proper endorsement durations, farmers can customize their insurance intends to align with their monetary objectives and risk resistance, ensuring a lasting and safe future for their livestock operations. Finally, buying LRP Insurance is an aggressive strategy for agricultural manufacturers to attain lasting monetary protection and protect their incomes.

Conclusion

In conclusion, Livestock Danger Defense (LRP) Insurance is a useful tool for animals manufacturers to mitigate market risks and secure their investments. By comprehending the benefits of LRP insurance coverage and taking actions to apply it, manufacturers can achieve long-lasting monetary safety for their procedures. LRP insurance provides a safeguard against price fluctuations and ensures a level of stability in an unpredictable market environment. It is a wise choice for safeguarding livestock financial investments.

Report this page